Commercial mortgage amortization period

1 to 25 year terms are offered with an amortization of up to 30 years. However commercial real estate loan amortization periods typically fall within the range of 20-30 years.

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

CMLS Conventional Term commercial mortgages are offered for most property types.

. Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25. Commercial real estate CRE loans comprise a major portion of many banks loan portfolios. Once it is determined an amortization schedule can be created that.

What Are Split Amortizations. Streamline the Commercial Property Financing Experience with Loans from 1M-25M. Typically a commercial real estate loan amortization period is between 20-30 years.

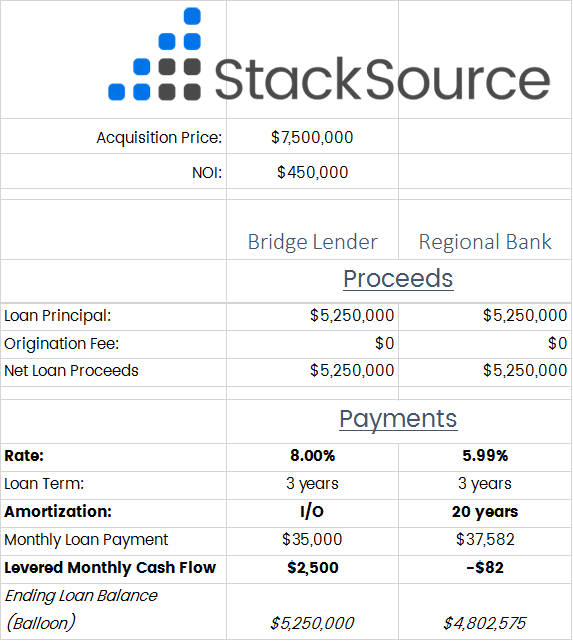

Interest rates vary drastically depending on risk. Commercial real estate loans have a set timeframe can range from between 3-5 years up to 20 years or even more in some cases and the amortization term is usually even more than the. This is a good place to start.

While residential mortgages typically have a 15 or 30-year. Demand for CRE lendinga. Generally speaking amortization is the process of paying back a loan in installments over a period of time.

5 Years 60 Months Floating or Fixed. Most multifamily loans are 30-year amortizations while core commercial loans are 25-year amortizations. Get Your Quote from JP Morgan.

1 Ranked online commercial lender. Ad Ready to Lock In Your Commercial Mortgage Rate. Apartment construction loans and multifamily construction mortgages.

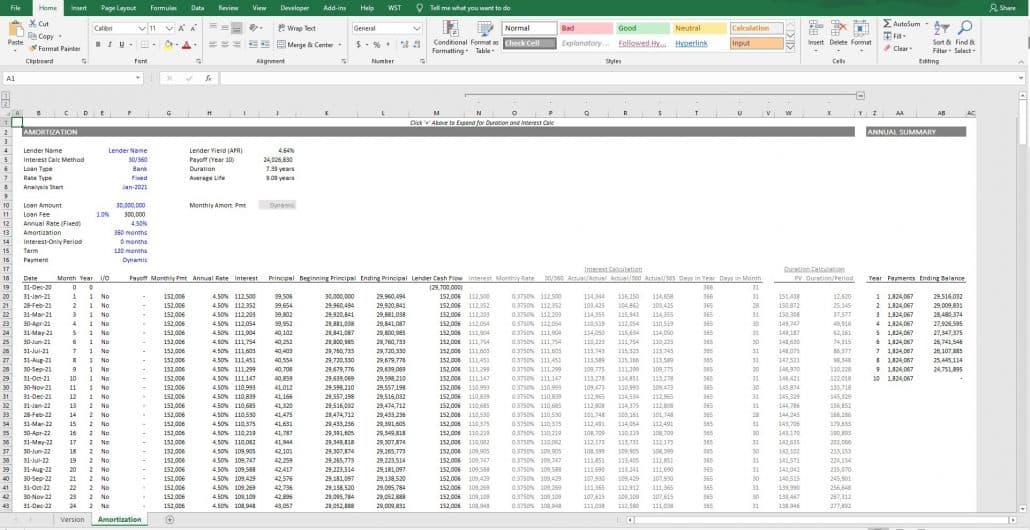

30 Years 360 months Interest Calc. The duration of most Commercial real estate mortgages varies from five years or less to 20 years and the amortization period is often longer than the term of the loan. Loan Amortization Years int.

Managing Commercial Real Estate Concentrations. Get Your Quote from JP Morgan. Streamline the Commercial Property Financing Experience with Loans from 1M-25M.

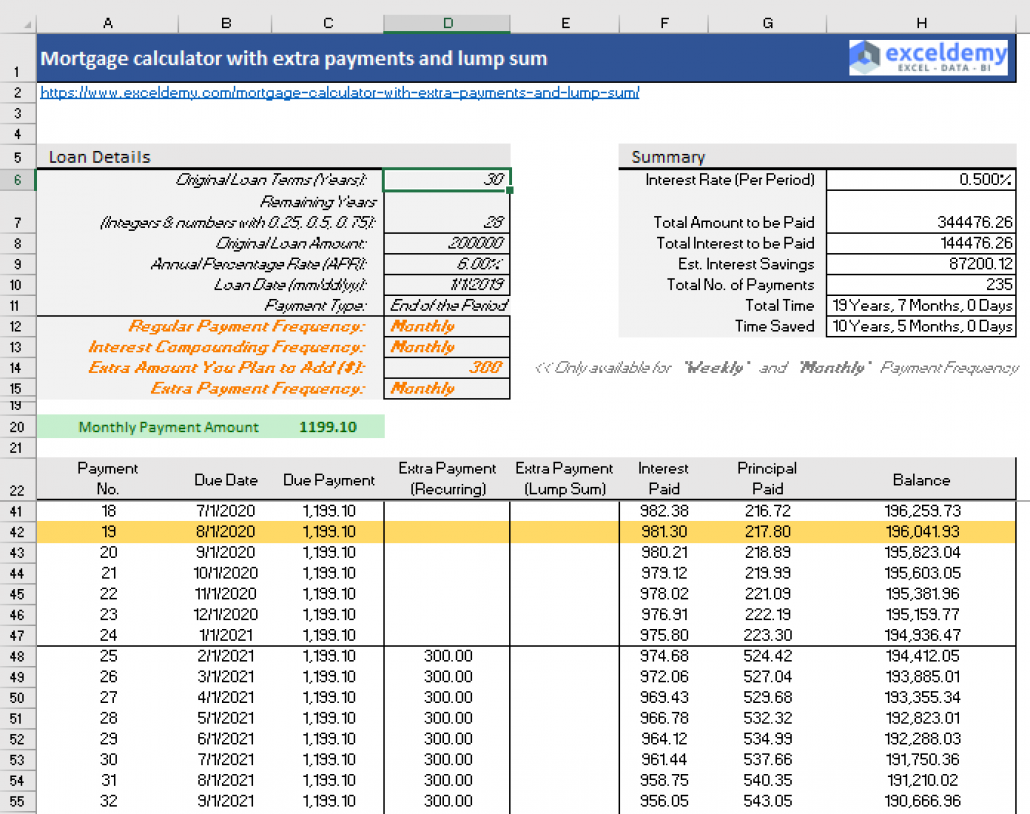

An example of split amortization would be a loan with a 5. The loan percentage paid off can be easily calculated by dividing the mortgage constant less loan interest rate by the loan amortization rate for the holding period less the loan interest. Ad Ready to Lock In Your Commercial Mortgage Rate.

Non Prime Financing 500 Fico 1 Day Out Of Bankruptcy Foreclosure Or Short Sale Bank Statement Program Availab Commercial Loans Usda Loan Mortgage Companies

The Advanced Mortgage Amortization Module Updated Jul 2022 Adventures In Cre

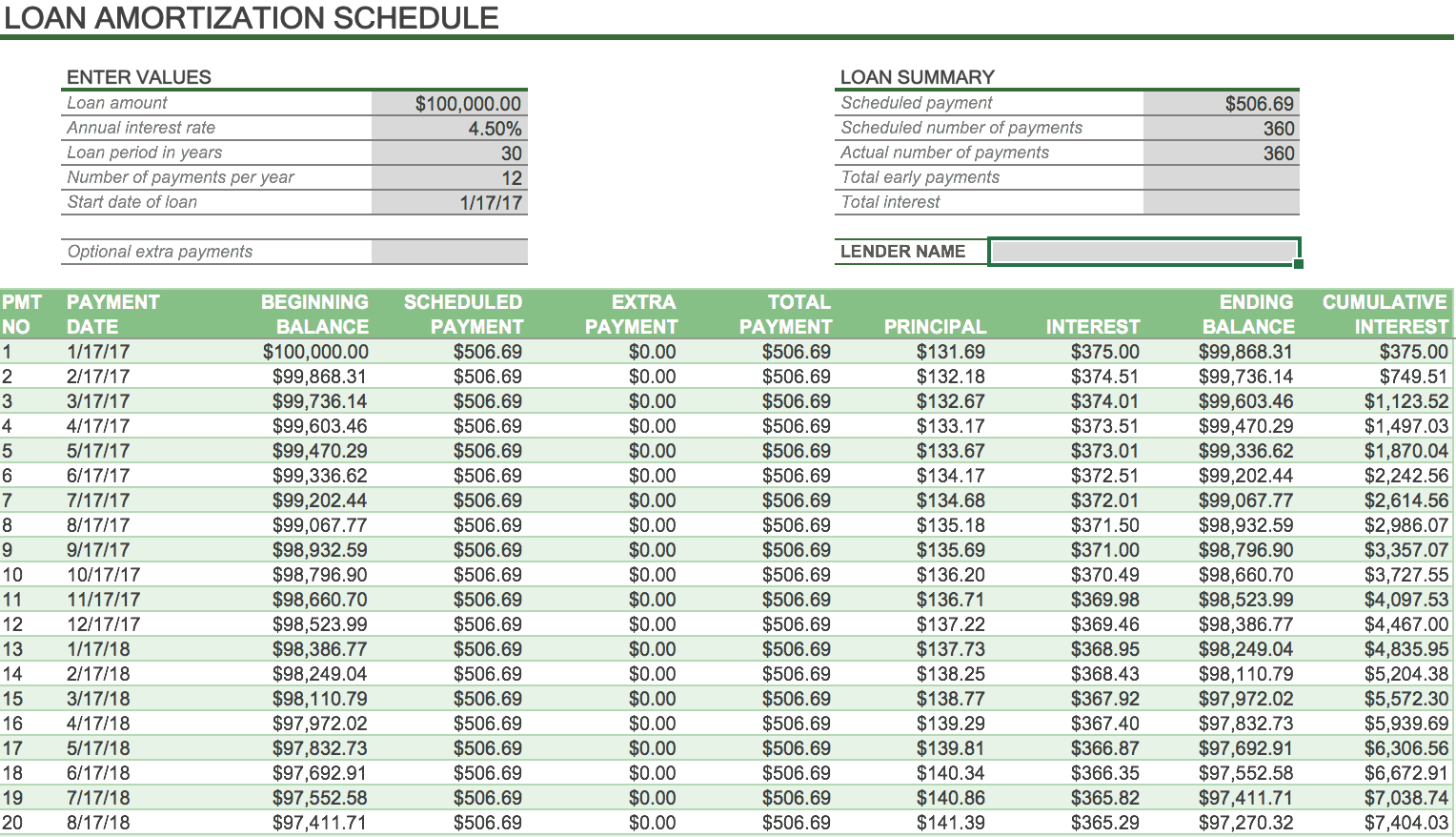

Use Excel To Create A Loan Amortization Schedule That Includes Optional Extra Payment Amortization Schedule Mortgage Amortization Calculator Schedule Templates

Bi Weekly Amortization Schedule How To Create A Bi Weekly Amortization Schedule Download Thi Amortization Schedule Excel Calendar Template Monthly Calender

/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Amortization Calculator

Loan Amortization Schedule With Variable Interest Rate In Excel

:max_bytes(150000):strip_icc():gifv()/amortizationschedule_definition_final_0804-4e9f8d46da6148d5b68ecb4acaf88c8d.png)

What Is An Amortization Schedule How To Calculate With Formula

Loan Amortization Table All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 74

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Loan Amortization Calculator Excel Tool Excel Template Etsy

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Home Loan Comparison Spreadsheet Amortization Schedule Loan Calculator Mortgage Amortization Calculator

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

5 Things You Need To Know About Amortization Schedules

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog

Time Value Of Money Board Of Equalization