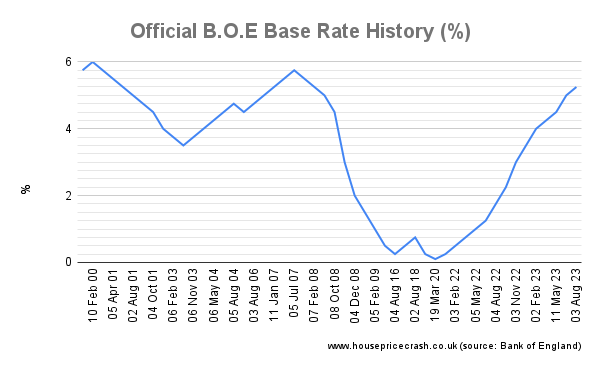

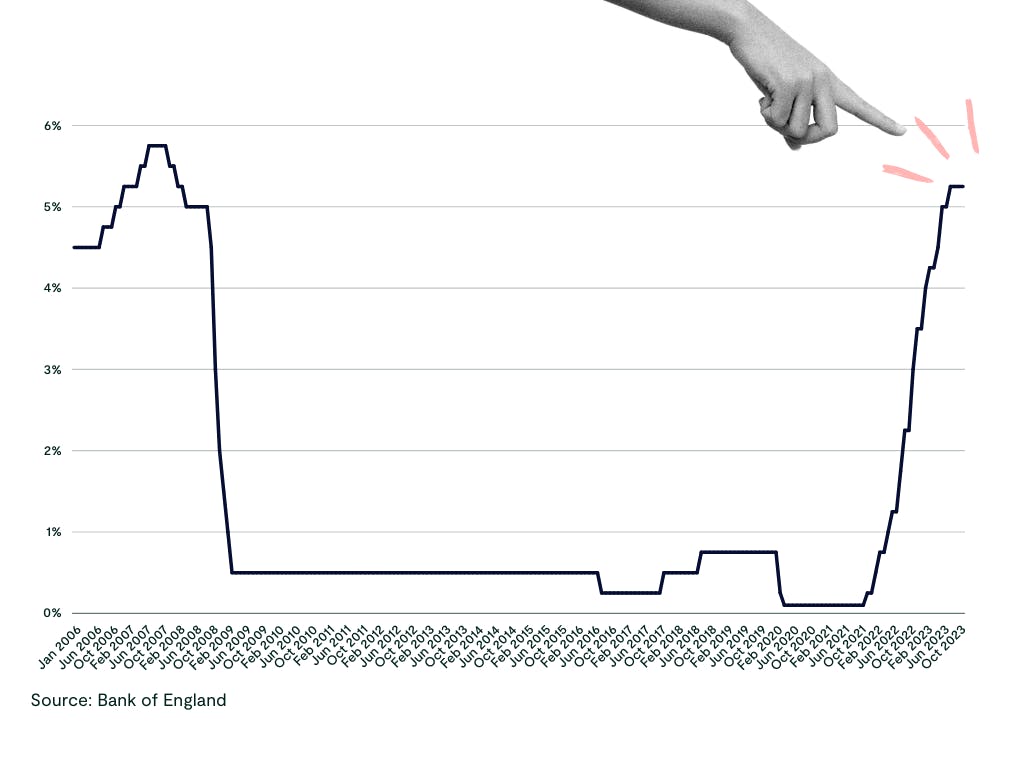

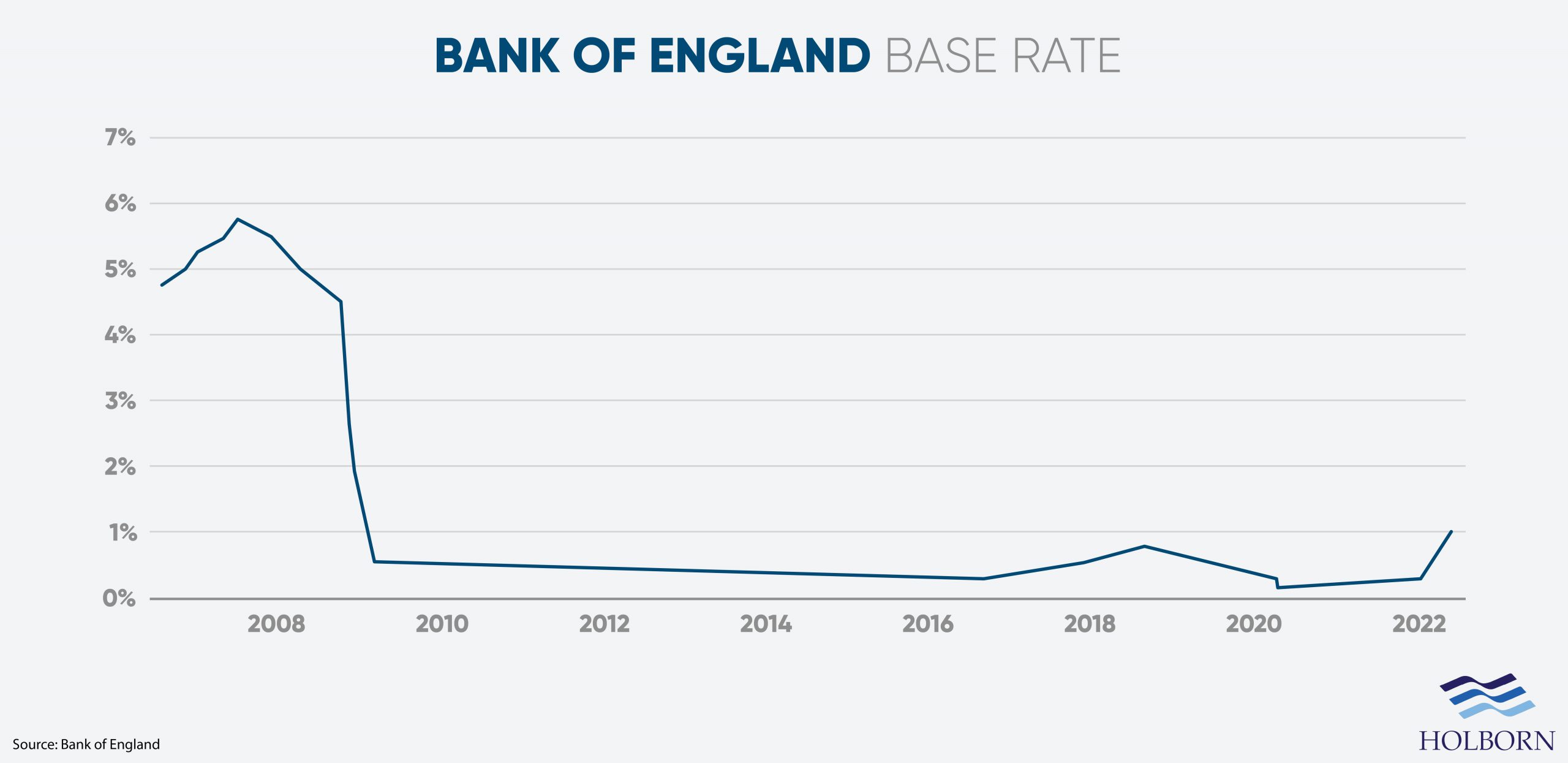

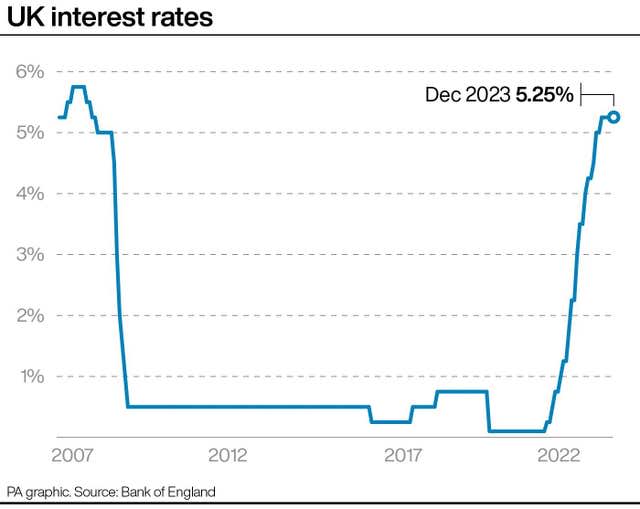

Bank of England base rate

Web Find out the current base rate of 525 set by the Bank of England and how it affects your mortgage payments. The move will affect.

Financial Times

Web On 1st February 2024 the Bank of England BOE kept the base rate at 525 its highest level in 15 years.

. Bank of England Bank Rate IBEBR 525 for Aug 03. Its the fourth time in a row that the Banks Monetary Policy Committee has opted to keep the base. Web The MPC voted by a majority of 6-3 to increase Bank Rate by 05 percentage points to 35 to curb inflation and support growth.

Web The Bank of England has voted to keep the base rate at 525. Find out why rates have been rising how they affect. Web The Bank of England announces its 12th consecutive increase in the base rate the highest level in almost 15 years to try to lower inflation.

The Bank of England Monetary Policy Committee announced an increase to the Bank of England base rate from 500 to 525 on 3 August 2023. Web The Bank of England has decided to keep the base rate unchanged for the third time in a row despite inflation pressures and a slowing economy. Web The Bank of England surprises the market by not raising the base rate in September 2023 despite inflation falling faster than expected.

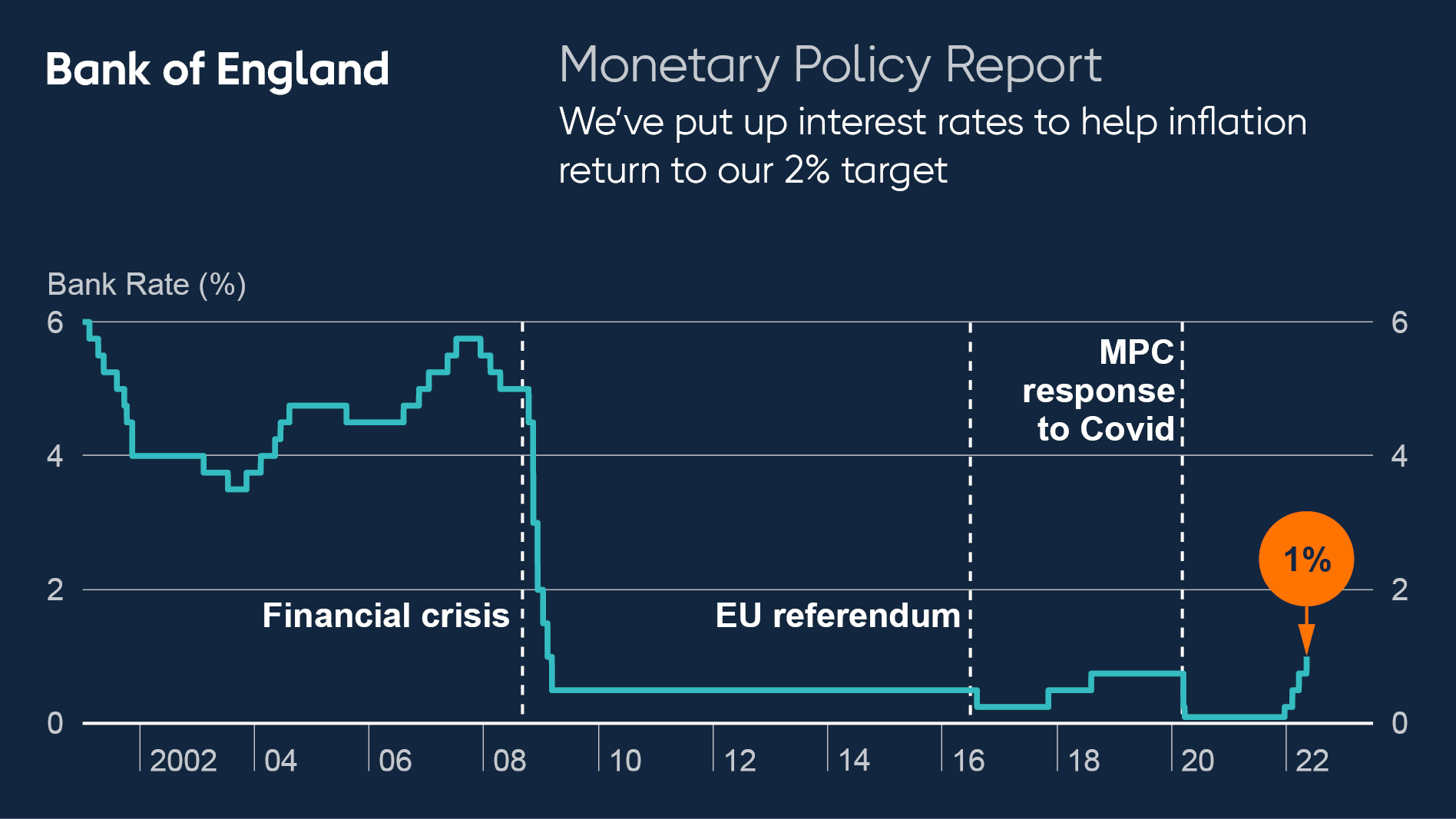

Web The Bank of England sets the Bank Rate which is currently 525 and aims to keep inflation at 2. Find out how this affects your mortgage credit card. Web The Bank of England has increased the base rate for the first time in three years amid rising inflation and Omicron concerns.

Find out what the rise means for. Follow live updates analysis and. Web The MPC increased Bank Rate by 05 percentage points to combat high inflation and slowing growth caused by gas price shocks and the Ukraine crisis.

Web The Bank of England has held the base rate at 525 since August 2023 despite inflation falling sharply. Web The Bank of England has increased the base rate to 1 in an attempt to curb inflation. Web The Bank says it will keep interest rates high for an extended period to curb price rises but growth will stall in 2023 and 2024.

The market is pricing in that the. Its the fourth increase since the start of December when the base rate was at. When will interest rates go down.

Web The Bank of England has paused its interest rate rises after 14 consecutive increases since December 2021. Web Index performance for UK Bank of England Official Bank Rate UKBRBASE including value chart profile other market data. Find out more about the Banks monetary and financial policies.

The Bank of England has raised the UK base interest rate to 525 Inflation is falling and thats good news. Web 253 rows Countries. Learn how to fix your rate compare deals and.

Web In depth view into Bank of England Bank Rate including historical data from 1975 to 2023 charts and stats. Web In a widely expected decision the Banks monetary policy committee MPC voted by a majority to keep interest rates at the current level of 525 the highest level. It says it will keep rates.

Al Jazeera

Financial Times

Capital Com

House Price Crash

Tembo

Oportfolio

Pound Sterling Live

Mascolo Styles

The House Of Commons Library Uk Parliament

Holborn Assets

1

![]()

Property Beacon

X Com

Statista

Www Psinvestors Co Uk

1

Gb News